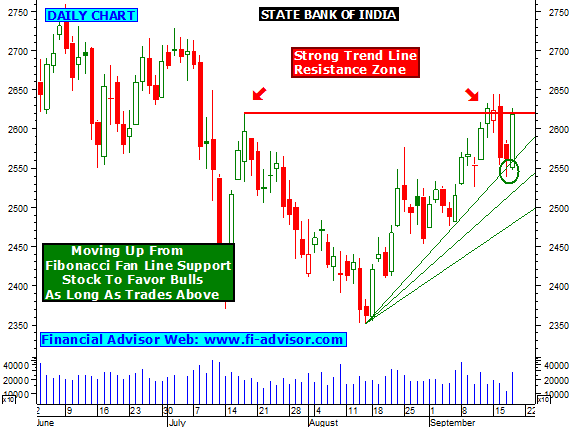

STATE BANK OF INDIA (SBIN)

- SBIN currently moving up from fibonacci fan line support, this indicates as long as stock holds above 2537 bulls will be favored. On upper side SBIN will find trend line resistance around 2645. Once stock closes and holds above 2645 then bulls will be favored and price up movement can be seen.

- Intraday close watch once SBIN starts trading above 2645, if holds above then intraday bulls action is expecting.

- Stock also moving up from 100 DMA, as long as holds above bulls will be favored, closing below 100 DMA indicates first sign of weakness.

- If stock moves up and closes above 2645 then will next strong resistance around 2730, 2760 and 2834. Close Watch.

- Visit link for Daily nifty futures technical analysis.