JSW HOLDINGS

- As per technical point of view JSW HOLDINGS in moving in a range bound zone, this indicates as long as stock moves in between its range trend will not clear, but once comes out from its range then sharp move is expecting.

- As pe graph no2 stock is moving in a up channel formation this indicates as long as stock moves in between up channel it will be favored by bulls, but if stock breaks it up channel on down side then sharp weakness is expecting in this stock.

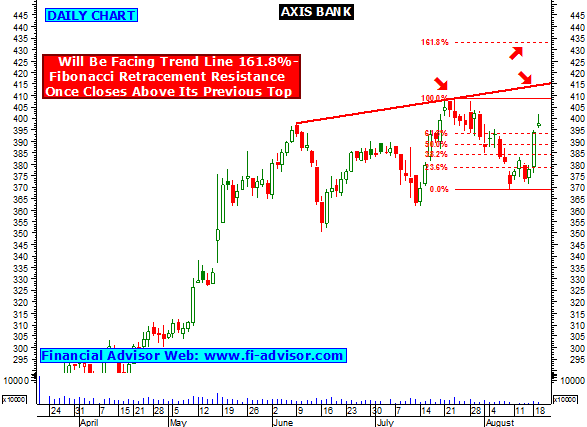

- Suggested Reading - AXIS BANK moving in up channel formation, stock will be favored by bulls.

- As per graph no3 stock is currently moving above its 50 and 100 days moving average this indicates the same trading above 50 DMA and 100 DMA will favor bulls. By looking closely technical indicates that stock is holding its 50 DMA from last 2 times stock took it 50 DMA support and bounced back and this time to JSW HOLDINGS is moving up from 50 DMA. Close Watch.

- Now if stock moves up from current levels and closes and stays above 908 its previous top then chart indicates stock will find next strong resistance around 1000 its 161.8% fibonacci retracement.

- Intraday close watch above 908, if stock holds above 908 during market hours then can see some intraday bulls action by JSW Holdings.

- Click here to see all the free trading reports (tips) published by us on JSW HOLDINGS.

- Tips on shares.