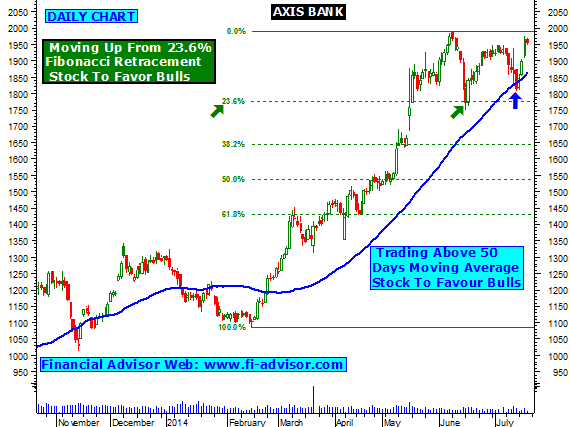

AXIS BANK

- AXIS BANK moving up from strong 23.6% fibonacci retracement support zone as shown above, stock also moving up from 50 days moving average, which indicates as long as stock holds above its support zone will favor bulls.

- Daily chart also indicates stock will find its strong trend line resistance (previous top) around 1990, once closes above its top and must holds above then stock will favor bulls for next 1-2 trading days.

- Intraday closes watch once stock starts trading above 1990, if breaks with volumes and holds above then we can see some intraday action in AXIS BANK.

- Daily chart also indicates if stock closes above 1990 and stock move further then stock will find next strong resistance 161.8% fibonacci retracement, as shown above. Close Watch.

- Suggested article to read from our collection - Understanding Japanese candlestick patterns.

No comments:

Post a Comment